20th June 2019

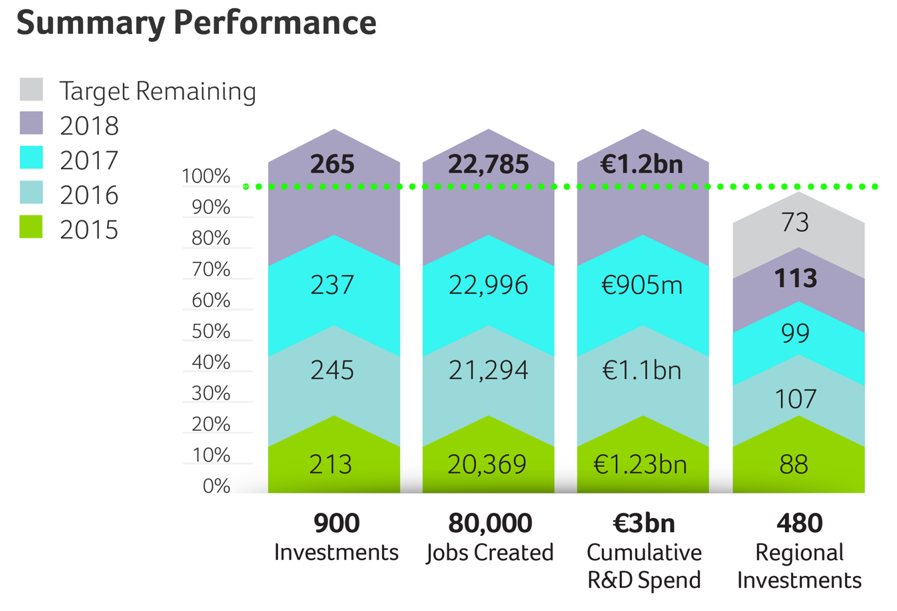

- IDA Ireland is on track to deliver all targets contained in the current “Winning” strategy by the end of 2019

- Regional strategy is working with 455 investments delivered to regions across Ireland

- Focus on Ireland’s competitiveness remains critical

- Over 80 projects and 5,300 jobs approved since June 2016 related to Brexit

- International campaign to highlight Ireland’s EU membership launched

IDA Ireland, the inward investment agency of the Irish Government has today reported a very strong first half of 2019 with 13,500 jobs approved – up 19% on the same time period last year.

Ireland won 140 projects in the first six months of the year – compared with 139 in the first half of 2018.

Over the course of the strategy, over 455 projects have been secured to June 2019 for the regions across Ireland. There has been an 32% uplift in regional investment to date in this strategy compared to our total outturn in our previous 5-year strategy.

Technology, Financial Services and Life Sciences sectors performed particularly strongly in the first half of the year.

Minister for Business, Enterprise and Innovation, Heather HumphreysTD said: “The IDA’s mid-year results for 2019 demonstrate the strength of foreign direct investment in Ireland. Overseas firms are continuing to invest and expand here, creating new jobs across the country.

“At a time of strong economic growth and almost full employment, it would be easy to become complacent – something that happened during the boom years. This Government is determined to make sure that this doesn’t happen again.

“It’s why we launched Future Jobs Ireland in March, a new whole-of-Government plan to answer the future needs of our businesses and workers. The plan is about preparing now for tomorrow’s world so that we can stay ahead of the curve and retain our pro-enterprise environment for investors both foreign and indigenous.

“It’s also why we are investing €116bn in Project Ireland 2040 to sustainably plan for the future and tackle the deficits in our infrastructure arising from the lost decade after the recession.

“And it’s why we are bringing forward the National Broadband Plan, among other measures, to ensure that we can continue to attract investment into the regions in this fourth industrial revolution.”

Martin Shanahan, IDA Ireland CEO said: “As we come to the end of our current Winning strategy, we are on course to have won record numbers of investments into Ireland.

“This strategy set very ambitious targets for achieving growth in the regions. Over the last four years, the whole Agency has been focused on securing investment for areas outside Dublin. We have achieved some remarkable investments in the first half of 2019. For example, Meissner committing to create 150 new jobs in Castlebar; Valeo investing 44m euro and creating an additional 50 jobs in Tuam; GrandPad setting up its European HQ in Gorey with the creation of 75 new jobs; JRI America adding 100 new roles at its Technology Centre in Tralee; Allergan creating 63 new roles in Westport and J&J Visioncare creating an additional 100 new roles at its facility in Limerick.

“The market for foreign investment is evolving at a rapid pace and has never been as competitive - none of IDA Ireland’s projects are easily won. I would like to take this opportunity to recognise and thank my colleagues in IDA Ireland who continue to seek out opportunities and pursue them, on Ireland’s behalf.

“IDA Ireland has consistently said that unless Ireland stays competitive, we will not continue to see these investment numbers, it’s as simple as that. Ireland cannot be complacent about its competitiveness.

“There needs to be a continued relentless focus on competitiveness and IDA Ireland will continue to work with Government to ensure that those areas prioritised by investors are addressed.”

IMPACTS OF FDI

IDA Ireland’s client companies continue to have a hugely positive effect on the Irish economy with over eight jobs being created for every 10 jobs in an FDI company. Multinational Companies (MNCs) invest directly into the Irish economy approx. €19.2bn including expenditure on Irish materials and services totalling €7.5bn, and an annual payroll spend of €11.7bn. In addition, MNCs inject capital expenditure of €5.7bn approx. on new buildings and machinery and equipment leading to high levels of employment in the construction sector.

A significant portion of the record corporation tax take (approx. two thirds) can also be attributed to the thriving IDA supported FDI sector in Ireland.

Overseas companies exported 67% of all national exports in 2017 (€189bn).

REGIONAL DEVELOPMENT

In 2015, IDA Ireland said that it would target a minimum 30% to 40% increase in the number of investments for each region outside Dublin. At this point in the strategy, IDA Ireland expects to achieve this target, delivering investment to regional Ireland.

Since the beginning of IDA Ireland’s ‘Winning’ Strategy, 455 Investments have been won for the regions. Almost 27,000 additional jobs have been added in locations outside of Dublin on the ground between 2015 and 2018, this is a testament to the focus IDA Ireland has placed on regional development and the whole of government action to enhance our regional offering, working in close collaboration with our national and regional stakeholders.

INTERNATIONAL CAMPAIGN

While IDA’s figures in recent years are showing strong gains and the overall outlook for FDI in Ireland is positive, the open nature of our economy means that we are exposed to effects of global economic developments and external economic shocks including: Brexit, trade tensions between

the US and its main trading partners and increased nationalism and protectionism.

These tensions are rippling into Ireland’s reputation and Ireland must remain cognisant of this. For instance, the investment message surrounding Brexit is being understood in different ways in different markets across the world. In some key markets, Ireland’s international economic reputation is closely aligned to that of the UK. Our shared language, time zone, geographical location, travel area and history all contribute to this association worldwide. To avoid any potential confusion amongst investors in the market around Ireland’s investment proposition in a post-Brexit world, IDA Ireland has launched an international campaign to remind current and potential international investors that Ireland’s investment proposition remains strong and independent of political actions taken in the UK. The digital and print ad campaign, which has been launched in the last fortnight and is running in the US and Japanese markets, will emphasise that now, more than ever, that Ireland is open for business.

COMPLETION OF STRATEGY

IDA Ireland is currently developing the agency’s new five-year strategy (2020 to 2024) in conjunction with the Department of Business, Enterprise and Innovation and Government – this will be completed in January 2020. This strategy will take account of the changing global landscape for FDI, changing sector profiles and changes in the nature of work and the impact of technology. There are significant changes occurring in the world of work and this is already reflected in the jobs being created by the IDA Ireland client base.

TAXATION

Ireland’s consistent and transparent tax regime continues to be an important part of Ireland’s offering to investors. The Government continues to take an active role in global work to reform the international corporate tax system. The publication of the OECD Base Erosion and Profit Shifting

(BEPS) reports in October 2015 was a significant milestone in this work. From the beginning, the key aim of the BEPS (Base erosion and Profit Shifting) project was to better align the taxing rights with real economic substance and activity and, as such, the key outcomes of the BEPS project align with Ireland’s own tax strategy.

Martin Shanahan, IDA Ireland CEO said: “The certainty that Ireland is offering across a number of policy areas is increasingly attractive. Taxation is one of a number of areas that investors look at when they choose to invest.”

Outlook

While recent reports from EY and FDI Markets have found that FDI into Europe declined slightly in 2018 (2% - 4%), IDA’s performance in the first six months of the year points towards 2019 being another successful year for Ireland winning FDI in a highly competitive marketplace. Ireland’s stable political and economic environment saw us win the largest ever number of first-time investors in 2018. The fact that this momentum continued in the first half of 2019, is particularly noteworthy and illustrates Ireland’s continued attractiveness to multinational companies.

Martin Shanahan, IDA Ireland CEO said: “While the immediate outlook to year end 2019 looks positive, there are significant downside risks to FDI in the medium term, these include: potential softening of growth in the global economy, the impacts of Brexit within Europe, escalating International trade tensions, and Ireland’s own competitiveness.”

ENDS

For further Information contact:

IDA Ireland Global Communications

Kevin Sammon - +353 876188564

Céline Crawford - +353 871147899

Notes to Editor

Company Investments Announced in 2019 to date include:

Company | Jobs | Location |

Salesforce | 1500 | Dublin |

Meissner | 150 | Castlebar, Co. Mayo |

IQVIA | 100 | Dublin |

GW Plastics | 200 | Sligo |

Valeo | 50 | Tuam, Co. Galway |

Forcepoint | 100 | Cork |

EML Payments Limited | 20 | Galway |

TradeIX | 70 | Dublin |

GrandPad | 75 | Gorey, Co.Wexford |

Markforged | 100 | Dublin |

FundRock | 45 | Limerick |

Oxford Global Resources | 25 | Cork |

Johnson & Johnson Vision | 100 | Limerick |

Greenfield Global Inc. | 75 | Portlaoise |

AFEX | 10 | Dublin |

LogMeIn | 200 | Dublin |

Rent The Runway | 150 | Galway |

Indeed | 600 | Dublin |

EcoOnline | 11 | Limerick |

Allergan | 63 | Westport, Co. Mayo |

The Knot Worldwide | 100 | Galway |

JRI America, Inc. | 100 | Tralee, Co. Kerry |

Reddit | 24 | Dublin |

TD Securities | 80 | Dublin |

QAD Inc. | 40 | Limerick/Dublin |

Allstate Sales Group Inc. | 100 | Waterford |

Back to Department News